Introduction: The Hidden Danger Behind Convenience

The digital age has made life easier. We can send money in seconds, pay bills from our beds, and manage our entire lives with a single device. But with this convenience comes danger — and one of the fastest-growing threats is online fraud. Whether it’s through deceptive links, OTP scams, or phishing, online fraud is becoming more sophisticated and dangerous every day. Everyone need to learn How to Be Safe from Online Fraud.

The real problem? It’s not just the uneducated or elderly falling victim. Even tech-savvy, educated people are being tricked. And in many cases, by the time you realize it, the damage is already done.

At SafeMe, our mission is to stop crime before it happens — and this article will give you everything you need to understand, recognize, and protect yourself and your loved ones from the growing wave of online fraud.

What Is OTP Fraud and How Does It Work?

One-Time Passwords (OTPs) are used to verify your identity during online transactions. But criminals have learned how to trick people into giving up this vital security code.

Here’s how online fraud using OTP usually happens:

- You receive a call pretending to be your bank.

- The caller says there’s a problem with your account.

- They ask you to verify the OTP they just sent — and once you do, they use it to steal your money.

But sometimes, the scam is even sneakier — they ask for a screenshot, and that screenshot contains your OTP.

Real Story: How Mr. Kerlin Lost $10,000 by Sharing a Screenshot

Mr. Kerlin once faced an emergency. A close friend was admitted to the hospital and the facility demanded $1,000 in cash — no online transfers accepted. Desperate and without access to cash or an ATM, she went to a nearby street café and asked the shopkeeper if he would take an online payment in exchange for cash. He declined.

A man nearby overheard and said, “I have $1,000 in cash, but I don’t know how to accept online payments. However, I know someone who does. If you send him the money, I’ll give you the cash.” With no other options, she agreed.

The man called someone and then asked Mr. Kerlin for her card number. Exhausted and stressed, she shared it. He then asked for the OTP that would arrive via SMS. She refused at first, knowing never to share OTPs. But he insisted she send a screenshot to confirm the payment, saying he had banking issues.

She sent the screenshot — not realizing the OTP was visible in it.

Minutes later, she received a notification: $10,000 had been debited from her account.

Panicking, she rushed to the police. The response was heartbreaking:

“This is your fault. You shared sensitive data with a stranger. We’ll investigate, but just so you know, you’re case number 47,390.”

She left shocked, realizing that online fraud had just ruined her night and possibly her savings.

SafeMe Tip #1: Never Share Your Phone or SIM

Scammers can:

Install hidden apps

They may quickly install remote-access or spy apps that silently run in the background. These apps can capture your messages, screen activity, and even steal login credentials without your knowledge.

Forward your calls

By enabling call forwarding settings, scammers can redirect verification calls (including voice OTPs) to their own numbers. You may never even know a call was meant for you.

Disable OTP delivery

Scammers can change your phone’s message or notification settings to silently block OTPs. This makes it easier for them to intercept or use OTPs without you realizing anything is wrong.

Change your SIM settings

They can request a SIM swap or port your number to another carrier, giving them full control of your phone number. This allows them to receive all future OTPs, calls, and texts intended for you.

If someone has your phone, they can access OTPs, reset your passwords, and even control your social media. Don’t let friends or relatives — even those who seem trustworthy — use your phone unsupervised.

Online fraud often begins with physical access to your device.

SafeMe Tip #2: Protect Your Card Details

Your card contains:

12–16-digit number (front)

This is your card’s identity. If someone knows this number, they can initiate purchases or link it to online accounts for fraudulent transactions.

Expiry date

The expiry date is often used along with the card number to verify purchases. Sharing this gives scammers another key to access your funds.

CVV (back)

This 3-digit or 4-digit code is the most critical for authorizing online purchases. Never reveal it — not even in a photo or over a call.

If scammers get these three pieces of information, they can make purchases or steal money from anywhere in the world. It doesn’t matter if your card is in your pocket — the digital theft has already occurred.

Never share screenshots of your card. Don’t send your card details to anyone over text or messaging apps. Most online fraud cases involving cards begin with simple negligence — just one moment of trust in the wrong person.

SafeMe Tip #3: Protect Your Parents and Children

Elderly people and children are frequent victims of online fraud because they may lack the technical skills or awareness to recognize suspicious behavior. It’s essential to proactively protect them from digital risks.

Avoid installing banking apps on their phones

Unless they are confident users, don’t install sensitive apps like banking, payment wallets, or investment platforms on their devices. These apps are targets for fraud if mishandled.

Turn off unnecessary permissions for apps

Go into phone settings and disable permissions like camera, file access, location, and SMS for social media and messaging apps. This prevents malicious apps from stealing OTPs, photos, or confidential data.

Don’t send remittances or money to accounts they don’t control

Often, scammers use the elderly as middlemen to receive or forward stolen money. Always verify who owns the receiving account. If sending funds to family abroad, use only verified and trusted channels.

Educate them not to share phones or SIMs

Teach them never to hand over their phone to strangers — even to someone pretending to help with a call or recharge. A fraudster can quickly forward OTPs, change SIM settings, or install spyware.

Use simplified or secure devices for children and seniors

Provide phones with parental controls or restricted access, especially for children or elderly people living alone. Disable features like online banking, file sharing, and unsecured browser access.

Regularly check their phones and accounts

Set a routine check every week to review messages, app permissions, and call forwarding settings. Guide them through what’s normal and what’s suspicious. Awareness is their best defense.

Many cases of online fraud happen because children or elderly family members unknowingly expose sensitive data. By being cautious and proactive, families can avoid emotional and financial losses.

Global Reach, Global Risk

Online fraud is not bound by geography, education, or income level. It’s a global threat — one that has reached villages in developing countries and the most sophisticated urban centers around the world.

Scammers operate across borders using international phone numbers, fake websites, and cloned identities. In cities like Toronto, London, Sydney, New Delhi, and Nairobi, victims have lost life savings in seconds — just by clicking a link or replying to a text. Technology is a powerful tool for good, but it’s also being used for deception at scale.

Here’s how fraud is spreading worldwide:

Fake bank calls

Scammers use spoofed numbers that appear to come from real banks. They mimic the official tone and language of customer service agents and trick users into revealing sensitive data or OTPs.

Phishing emails

Emails that appear to be from your bank, courier company, or even government services often contain malicious links. Once clicked, they download spyware or lead you to fake login pages.

Voice-based OTP scams

In many countries, OTPs are now delivered by automated calls. Fraudsters use this to impersonate call centers and ask you to “verify” your OTP verbally.

SIM cloning and SIM swapping

By convincing mobile providers to transfer your number to another SIM, scammers gain full control over your phone — including all OTPs, messages, and calls.

Social engineering

Scammers research their victims using social media to sound convincing. They may pretend to be a family member in distress, a friend asking for help, or even an official authority figure.

No matter where you live or how educated you are, online fraud can strike. That’s why global awareness, digital literacy, and platforms like SafeMe are essential to prevention.

Never Share OTP — Not Even in a Screenshot

Just one screenshot can reveal your OTP, card number, bank name, and even account balance. Scammers know how to zoom in, crop, and use it before you even realize it.

If you must share a screenshot, black out any sensitive information first. Better yet, don’t send it at all.

This is one of the top ways online fraud occurs — and it’s entirely preventable.

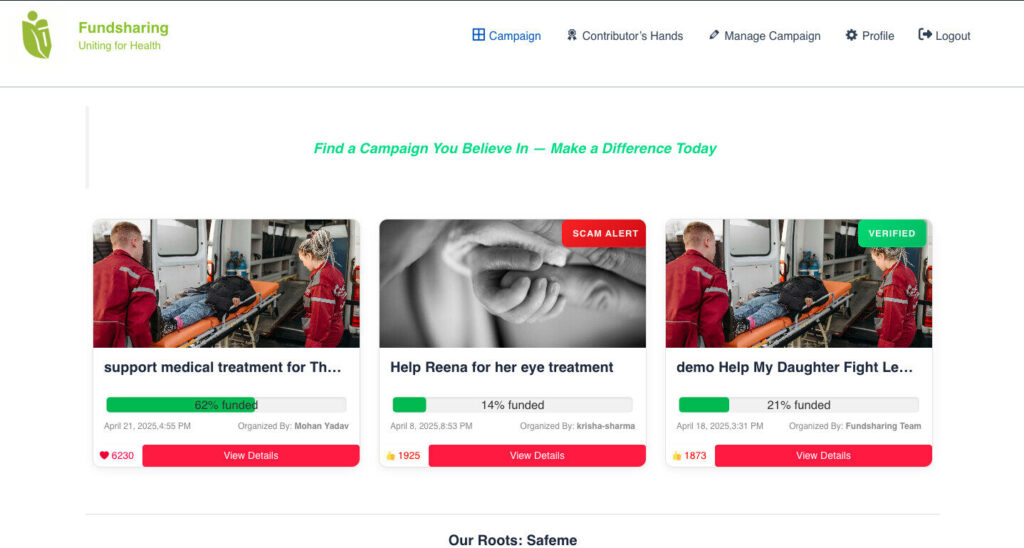

We Currently Have 132 Campaigns in 62 Countries

SafeMe and Fundsharing.org are actively helping real victims and families. We currently have 132 campaigns running in 62 countries, many of them launched after someone fell victim to digital crimes like online fraud.

If you’re in need, or someone you love has been scammed, create a campaign to ask for help — or just read their stories to learn and stay alert.

Final Reminder: Share This Knowledge

Most people who fall victim to online fraud never thought it could happen to them.

So take action:

- Share this article with your parents.

- Teach your children not to trust unknown callers.

- Talk to your friends about OTP fraud.

- Report any suspicious messages immediately.

At SafeMe, we believe the best way to stop crime is to educate before it happens.

💙 SafeMe: Your Partner in Digital Safety

We’re committed to building tools, stories, and education that save lives and protect families. If this article helped you, share it. If you need help, reach out.

Together, we can stop online fraud before it starts.

Read More Articles:

- 🔗 Top NGOs in the World

- 🔗 Reasons People Don’t Donate

- 🔗 How to Choose a Campaign

- 🔗 Why Donate Online?

- 🔗 Top 10 Foundations in the World

- 🔗 Top 10 Most Charitable Countries

- 🔗 How to Start Fundraising

- 🔗 How to Become Successful in Fundraising

- 🔗 How to Fundraise Without Social Media

- 🔗 The Global Medical Debt Crisis

- 🔗 Importance of Donors in Healthcare

- 🔗 How to Get Help Paying for Emergency Surgery

- 🔗 How to Make Your Fundraiser Go Viral

- 🔗 How to Save a Life During a Medical Emergency

- 🔗 How to Ask for Donations Online

- 🔗 Financial Help for Hospital Bills

- 🔗 Wireless Security Cameras Risks

- 🔗 Facebook Hacking: What You Need to Know

- 🔗 How to Tackle with Suicidal Thoughts